What Type of Will do I Need?

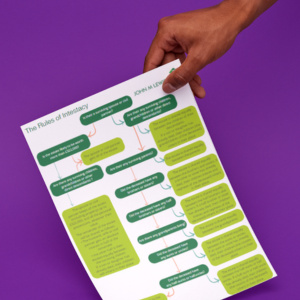

We all know Wills are important, but do you know which type of Will is best for you? Different types of Will give you different benefits and levels of protection. Understanding what type of Will you need is crucial for protecting your assets. Use our Wills questionnaire on this page to determine which best suits you.